Innovative IT solutions are accelerating the growth of companies ready to take bold steps into the future. Find out which technology trends can effectively increase savings and boost profits for companies in the insurance industry.

Key takeaways from this article

- Data warehousing and Machine Learning can increase revenues by up to 15% per year.

- Cloud Computing reduces IT infrastructure costs by making it easier to deploy new systems and tools in the future.

- Implementing a self-service portal significantly reduces the risk of losing customers.

Drive digital transformation with a partner who understands your needs

Increase revenue by 15% per year with Data Warehousing and Machine Learning

Achieve the full potential of your data

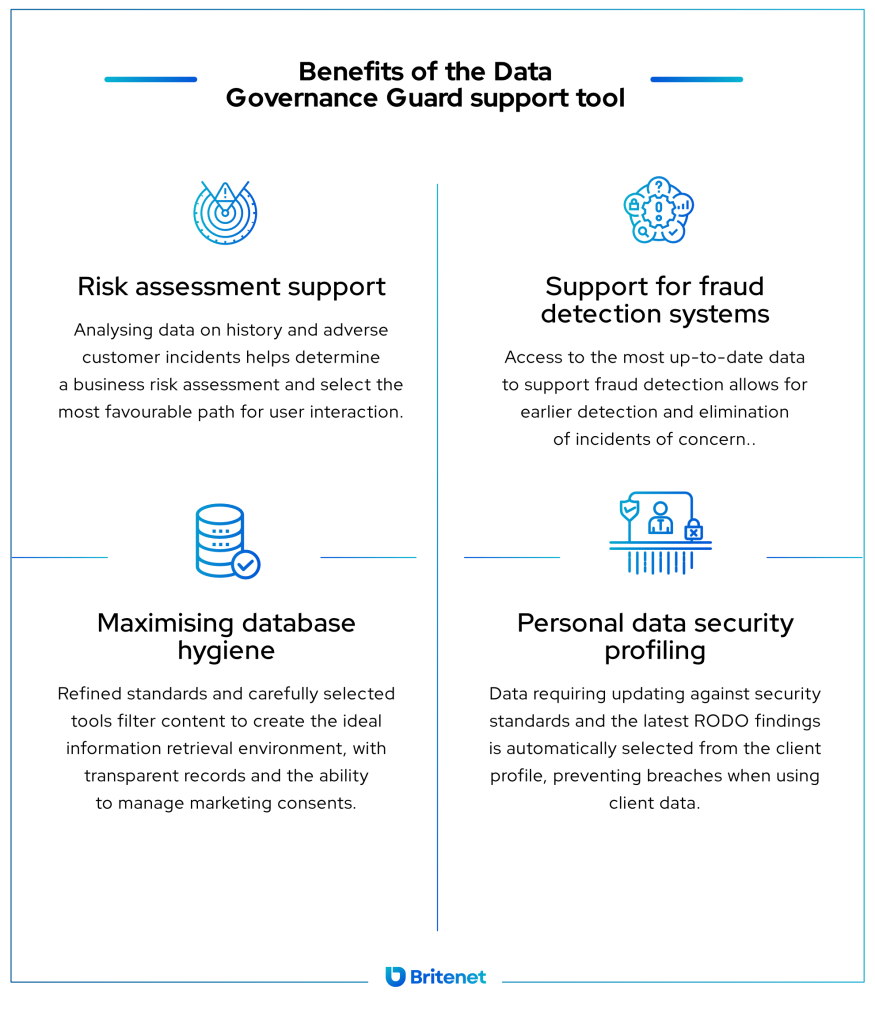

Large volumes of inconsistent and unstructured data dispersed across different systems can lead to large financial losses and loss of market position. Lack of control over data means wrong business decisions, the risk of security breaches and higher project implementation costs. The Data Warehouse, combined with Machine Learning algorithms, enables better use of data for e.g., risk assessments, fraud detection and guaranteeing security and tailored services to customers.

Building a data warehouse is becoming a key element in ensuring competitiveness in the insurance market. By centralising the collection of customer data, policies, damage, and risk information, we can analyse market trends more effectively, identify new business opportunities and respond more quickly to changes in customer needs.

An example of the savings that can be achieved by building a data warehouse is Generali, a company that invested in this technology. By centralising its data, the company was able to optimise its risk allocation processes, identify high-risk areas, and, as a result, manage its policy portfolio more effectively.

Why build Data Warehouses?

Insurers are harnessing the power of data warehouses and machine learning algorithms to gain deeper insights into customer behaviour, risk assessment, and claims management. By analysing diverse datasets, they can make better-informed decisions, optimise processes, and enhance customer experiences. Utilising data warehouses and machine learning algorithms can unlock valuable insights and drive revenue growth. By leveraging predictive analytics, insurers can identify cross-selling opportunities and improve customer retention rates, leading to potential revenue increases of up to 15% annually.

We turn our experience into your success and security.

Find out how we have supported the operation of a leading financial institution in Poland.

Cloud Computing – an effective way to reduce IT infrastructure costs

Use Cloud Computing to accelerate business growth

The lack of appropriate tools and IT systems prevents companies in the insurance industry from effectively managing large amounts of data and keeping it secure. A good way to increase the efficiency of operations and accelerate digital growth is cloud computing. Cloud services guarantee better scalability of IT infrastructure, pave the way for efficient data management and accelerate the implementation of innovative applications and solutions.

What savings does Cloud Computing bring?

The widespread adoption of cloud computing is empowering insurers to achieve greater operational efficiency, cost savings, and scalability. Cloud infrastructure facilitates seamless data integration, personalised experiences, and enhanced security measures, albeit with ongoing concerns regarding data privacy and cybersecurity. The adoption of cloud computing offers significant cost savings and revenue-generating opportunities. Insurers can reduce IT infrastructure costs by up to 30%, while also enhancing agility and scalability, resulting in potential annual savings of tens of millions of euros for large or even medium insurance firms.

Reduced claims costs by almost 50%, due to telematics for insurance and usage based claims

Is it possible to reduce customer abuse? Yes!

Declarations made by customers may not always be entirely truthful, and they are usually verified once the damage has already occurred - at which point it becomes apparent that the premium was not matched to the actual risk. Telematics solutions allow key parameters such as driving patterns to be monitored on an ongoing basis, allowing potential risks to be more easily identified and premiums to be tailored to the individual customer.

Increase the profitability of your business using telematics

Telematics technologies enable insurers to capture real-time user data for personalised insurance products and perform more accurate claims processing. By leveraging data from connected devices and black box telematics, insurers can mitigate risks, prevent fraud, and offer tailored coverage options to customers. Telematics technologies enable insurers to optimise risk assessment and claims management processes. By leveraging usage-based insurance models, insurers can reduce claims costs by up to 40% and enhance profitability by attracting lower-risk customers, resulting in potential annual savings of billions of dollars industry-wide.

Digital Distribution & Self-service – the key to greater customer satisfaction

Is it possible to increase customer convenience and save money at the same time? Yes!

Today's customers value convenience, easy access and speed of service - companies that do not embrace digital solutions to enhance the customer experience are losing customers to better prepared competitors. Self-service portals and digital distribution offer users full control over their account and insurance policies, and offer the ability to get things done without leaving home. This convenience translates into greater customer satisfaction and loyalty.

Why develop self-service portals and digital platforms?

Self-service portals and digital distribution platforms are transforming the way customers purchase insurance products and interact with insurers. By providing convenient, accessible channels for policy acquisition and management, insurers enhance customer satisfaction, reduce administrative burdens, and increase operational efficiency. Digital distribution channels and self-service portals can enhance customer experiences and reduce acquisition costs. Insurers can achieve cost savings of up to €500 per policy through digital distribution, while also improving customer satisfaction and retention rates, leading to potential annual savings of millions of dollars.

Conclusion

Key to success for companies in the insurance industry are technological innovations such as synthetic data, data warehousing or advanced machine learning algorithms, which enable process optimisation, improve customer experience and effectively reduce the risk of fraud and improve data security. The main problem for many companies, however, remains choosing the right tools for their specific business needs and creating synergies between systems to guarantee a full return on investment.

Harnessing the full potential hidden in new technologies is only possible by working with a trusted IT partner who, through the knowledge and experience of its experts, is able to identify the optimal direction of digital development and then accelerate it significantly.